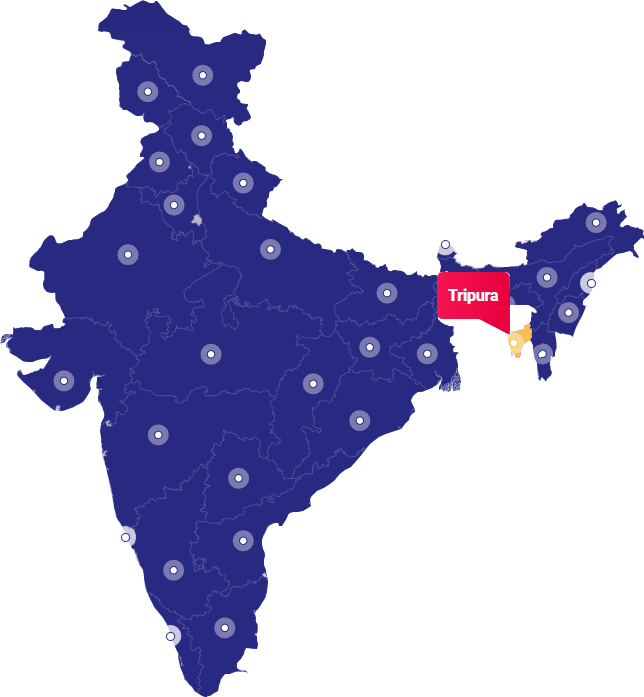

Tripura is a north-eastern state of India and is surrounded by Bangladesh on three sides. The economy of Tripura is predominantly agrarian.

Agriculture provides livelihood to almost 42% of its total population (Source: Directorate of Economics and Statistics, Govt. of Tripura).

In the absence of other major natural resources, development of the state economy, to a great extent, hinges on the development of agriculture and related activities.

The agriculture sector in the state has remained mostly confined to production, without much value addition in farm level.

The activities related to post harvest and food processing are in its very initial stages. The main drawback is being poor connectivity with the big markets (in larger urban centers) and the restricted movement of goods due to remoteness.

This affects the marketing of agricultural produce in general and perishable produce in particular. Lack of processing and associated storage facilities result in high wastages and distress selling by farmers during the peak production season.

Government of Tripura has identified food processing as a thrust area to accelerate growth in agriculture and it has realized that this can be achieved only through creating infrastructure for food processing and developing an efficient supply chain in the state. With the concerted efforts of both Central Government and State Government, it is expected to catalyze a robust agriculture based industry in the state.

Productivity level of Food Grain of Tripura

Food Grain - 27% more than all India level

Productivity of Rice

Rice - 22% more than all India levels

Agriculture and allied activities has been remained as the backbone of the State's economy. About 52 per cent of total main workers are engaged in agriculture including 28 percent cultivators and 24 percent agricultural labourers. Small and marginal farmers constitute 96 percent of the total farmers in the state against all India figures of 78 percent. Availability of cultivable land is one of the main constraints in the state.

With the burgeoning population and growing food demand, there is hardly any scope of getting additional land for cultivation of food crops. At present there is a gap between actual production and requirement of food grains in the state. In addition to it, the productivity for cereals and pulses etc is also low as compared to the National Average. Favourable agro-climatic conditions like fertile soil, sub-tropical/tropical climate and abundant rainfall, etc. offer good scope for improvement of production of various fruits, vegetables, spices and plantation crops.

The Area, Production and Productivity of major commodities in Tripura during 2018-19 (Provisional) are tabulated below:

| District Name | Company Name | Status | Contact Details | Investment Leverage (Rs. in Cr.) | Direct Employement Granted (in Nos.) | Farmers Benefited (in Nos.) | Processing Capacity (LMT) PA | Preservation Capacity (LMT) PA |

|---|---|---|---|---|---|---|---|---|

| WEST TRIPURA | Sikaria Mega Food Park Private Limited | Completed | Avinash sikaria Email: mukherjeegc[at]yahoo.co[dot]in Mobile: 9903046587 |

29.4000 | 50 | 268 | 0.0720 | 0.3040 |

| District Name | Company Name | Status | Contact Details | Investment Leverage (Rs. in Cr.) | Direct Employement Granted (in Nos.) | Farmers Benefited (in Nos.) | Processing Capacity (LMT) PA | Preservation Capacity (LMT) PA |

|---|---|---|---|---|---|---|---|---|

| Record not available. | ||||||||

| District Name | Company Name | Status | Contact Details | Investment Leverage (Rs. in Cr.) | Direct Employement Granted (in Nos.) | Farmers Benefited (in Nos.) | Processing Capacity (LMT) PA | Preservation Capacity (LMT) PA |

|---|---|---|---|---|---|---|---|---|

| Record not available. | ||||||||

| Warehouse Name | Name and Address | Mobile | Capacity (MT) |

|---|---|---|---|

| Central Warehousing Corporation | CW-Agartala (H),Central Warehouse, Agartala (H), P.O. Hapania, Near ONGC Complex, Agartala, , Distt-West Tripura | 9555784075 | 19250 |

| S. No. | District | ODOP |

|---|---|---|

| 1. | Dhalai | Multiple Fruit Processing |

| 2. | Gomti | Multiple Fruit Processing |

| 3. | Khowai | Rice based products (puffed rice, chira, snacks etc) |

| 4. | North Tripura | Tea Products |

| 5. | Sipahijala | Dairy based product |

| 6. | South Tripura | Bakery products |

| 7. | Unakoti | Multiple Fruit Processing |

| 8. | West Tripura | Bakery products |

| Policy & Incentives | Description |

|---|---|

| Name of Policy | Tripura Industrial Investment Promotion Incentive Scheme (TIIPIS, 2017). Food Processing sector has been declared as Thrust sector for investment with provision of additional subsidy. |

| Nodal Agency | Department of Industries & Commerce, Government of Tripura |

| Single Window Clearance System |

|

| Capital Subsidy |

|

| VAT/CST/SGST/TAX Exemption/Reimbursement |

|

| Employment Generation |

|

| Freight/Transport Subsidy |

|

Connect with us for any Investment Related Query

+91 92 0548 0590